Transforming Bookkeeping for Small Businesses with Vernacular AI Technology

India’s digital transformation has entered a new phase. While UPI payments, GST filing portals, and online banking have already simplified financial operations, accounting remains a challenge for millions of small businesses. For shop owners, traders, and local entrepreneurs, bookkeeping still feels complicated, time-consuming, and heavily dependent on English software interfaces.

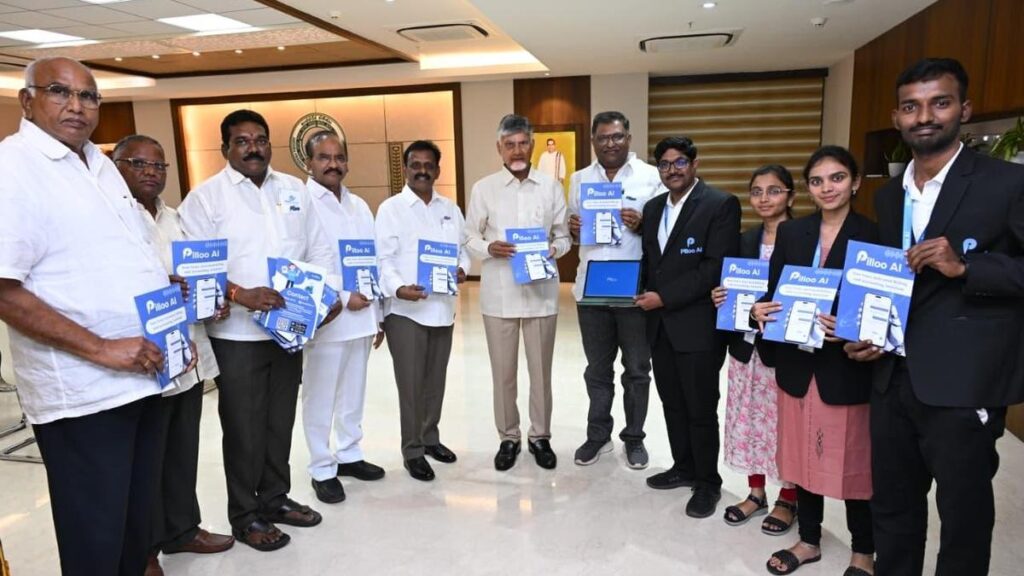

Addressing this long-standing gap, Pilloo AI has been launched as an innovative voice-based accounting assistant that allows users to manage their finances using simple spoken commands in local languages. This breakthrough solution is set to redefine how small and medium businesses (SMBs) handle daily accounting tasks — without needing accounting expertise or English proficiency.

With vernacular voice support, artificial intelligence automation, and user-friendly design, Pilloo AI promises to make accounting as easy as talking to a friend.

Why India Needed Voice-Based Accounting

India has over 63 million MSMEs, contributing nearly 30% to the country’s GDP. Despite this massive presence, many business owners still rely on:

- Paper notebooks

- Manual ledger entries

- Excel sheets

- Third-party accountants

The primary reasons are:

- Lack of English fluency

- Complex accounting software

- Fear of technology

- High software subscription costs

- Limited financial literacy

For a kirana store owner or small manufacturer, traditional accounting platforms feel overwhelming. Terms like “debit”, “credit”, “ledger reconciliation”, or “trial balance” can create barriers.

Pilloo AI bridges this gap by letting users simply speak their transactions naturally, just like they would explain it to their accountant.

What is Pilloo AI?

Pilloo AI is an AI-powered voice accounting platform designed specifically for small businesses and non-technical users. Instead of typing entries, users can speak commands in their preferred regional language.

For example:

- “Record ₹5,000 cash sale”

- “Add purchase of rice from Ramesh Stores ₹2,300”

- “Show today’s profit”

- “How much do customers owe me?”

- “Generate GST report”

The AI automatically understands, categorizes, and updates the books in real time.

This conversational approach removes the complexity of accounting software and creates an experience that feels natural, fast, and stress-free.

Key Features of Pilloo AI

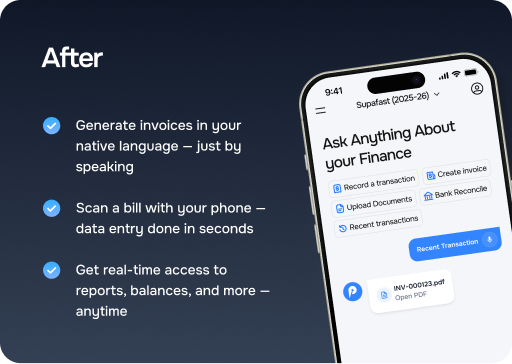

1. Voice-Based Accounting

Users can add transactions simply by speaking. No typing required. This saves time and makes bookkeeping accessible to anyone.

2. Local Language Support

One of Pilloo AI’s biggest strengths is vernacular capability. The platform supports multiple Indian languages such as:

- Tamil

- Hindi

- Telugu

- Kannada

- Malayalam

- Marathi

- Bengali

This makes it inclusive for millions of regional entrepreneurs.

3. Smart AI Categorization

The AI automatically detects whether a transaction is:

- Sale

- Purchase

- Expense

- Income

- Credit/Debit

- Inventory update

Users don’t need accounting knowledge.

4. Real-Time Reports

Business owners can instantly ask:

- “What is today’s sales?”

- “Show monthly expenses”

- “How much GST payable?”

Reports are generated instantly without manual calculations.

5. GST & Compliance Ready

Pilloo AI simplifies GST management by preparing:

- Sales reports

- Purchase summaries

- Tax calculations

- Filing-ready data

This reduces dependency on external accountants.

6. Mobile-Friendly Design

The platform is optimized for smartphones, making it perfect for on-the-go business owners.

7. Data Security

Cloud backup and encryption ensure financial records are safe and accessible anytime.

How Pilloo AI Works

The system uses advanced technologies like:

- Natural Language Processing (NLP)

- Speech Recognition

- AI-based accounting logic

- Machine learning

When a user speaks, the AI:

- Converts speech to text

- Understands the intent

- Categorizes the transaction

- Updates books automatically

- Generates real-time reports

All this happens in seconds.

The result is a seamless and intuitive accounting experience.

Benefits for Small Businesses

Saves Time

Manual entry takes hours. Voice entry takes seconds.

Reduces Errors

AI automation minimizes calculation mistakes.

No Technical Skills Needed

Anyone who can speak can manage accounts.

Cuts Costs

Reduces dependency on expensive accountants or software.

Improves Financial Awareness

Instant reports help owners understand profits and losses daily.

Encourages Digital Adoption

Even non-tech users feel comfortable using voice technology.

Who Can Use Pilloo AI?

Pilloo AI is designed for:

- Kirana stores

- Retail shops

- Wholesalers

- Small manufacturers

- Street vendors

- Service providers

- Freelancers

- Home-based businesses

- MSMEs

- Self-employed professionals

Basically, anyone running a small business can benefit.

Impact on India’s MSME Ecosystem

Voice-based accounting could become a game changer for India’s economy.

Financial Inclusion

Millions of non-English speakers can now access digital bookkeeping.

Formalization of Businesses

Better records encourage tax compliance and access to loans.

Improved Credit Access

Proper accounts help banks evaluate businesses for funding.

Increased Productivity

Owners spend less time on accounting and more on growth.

Digital India Vision

Supports the government’s push for digitization and fintech innovation.

The Future of Voice Accounting

Voice technology is rapidly expanding worldwide. From Alexa to Google Assistant, people are comfortable speaking to machines.

Accounting is the next logical step.

Experts predict:

- Voice-based bookkeeping will become mainstream

- AI accountants will automate most routine tasks

- MSMEs will adopt vernacular fintech tools faster

- Real-time financial intelligence will improve decision-making

Pilloo AI is among the early innovators leading this change.

In the coming years, we may see:

- Invoice generation by voice

- Payment reminders via AI

- Auto tax filing

- Predictive business insights

- Voice-based inventory control

The possibilities are endless.

Challenges to Watch

While promising, adoption may face some hurdles:

- Initial tech hesitation

- Internet connectivity issues in rural areas

- Language accent variations

- Data privacy concerns

However, as awareness grows and technology improves, these challenges are likely to reduce.

Why Pilloo AI Stands Out

Unlike traditional accounting apps that simply digitize ledgers, Pilloo AI changes the interaction model itself.

Instead of learning software, the software understands the user.

This human-centric design makes it uniquely suited for India’s diverse and multilingual market.

By combining AI, voice, and vernacular languages, Pilloo AI solves a real, everyday problem for small business owners.

Conclusion

The launch of Pilloo AI marks an important milestone in India’s fintech and MSME ecosystem. By enabling voice-based accounting in local languages, it removes long-standing barriers of language, complexity, and cost.

For millions of entrepreneurs, managing accounts may finally become simple, quick, and stress-free.

As India continues its journey toward digital empowerment, innovations like Pilloo AI show how technology can be inclusive, practical, and transformative.

The future of accounting might not be typed — it might just be spoken.