In a significant move to strengthen customer trust and combat rising cyber threats, Axis Bank has launched a dedicated digital initiative called ‘Safety Centre’, aimed at enhancing digital banking security and fraud awareness. As India rapidly transitions toward a cashless and digitally driven financial ecosystem, this initiative marks a proactive step by the bank to protect customers from evolving cyber risks.

With digital transactions becoming an everyday necessity—from UPI payments and mobile banking to online investments—Axis Bank’s Safety Centre seeks to empower users with knowledge, tools, and real-time guidance to stay safe in the digital space.

The Rising Need for Digital Banking Security in India

India has witnessed explosive growth in digital payments over the past decade. Mobile banking apps, UPI platforms, and internet banking have made financial services more accessible than ever. However, this rapid adoption has also led to a sharp increase in:

- Phishing scams

- Identity theft

- Fake banking calls and messages

- Malware and remote access frauds

Cybercriminals are constantly devising new techniques to exploit users’ lack of awareness. Recognizing this challenge, Axis Bank introduced the Safety Centre to bridge the gap between technology and customer awareness.

What Is Axis Bank’s ‘Safety Centre’?

The Axis Bank Safety Centre is a centralized digital platform designed to educate, alert, and assist customers in identifying and preventing online financial fraud. Rather than reacting after fraud occurs, the initiative focuses on prevention-first banking security.

The Safety Centre acts as:

- An information hub for digital safety

- A fraud-awareness education platform

- A real-time advisory system for customers

It reflects Axis Bank’s commitment to responsible banking and customer-first digital transformation.

Key Objectives of the Safety Centre

Axis Bank’s Safety Centre has been developed with three core objectives:

1. Customer Awareness

Educating users about common and emerging digital fraud techniques.

2. Prevention

Helping customers identify red flags before falling victim to scams.

3. Empowerment

Enabling customers to take control of their digital banking safety through informed decision-making.

This shift from reactive fraud handling to proactive prevention is a major evolution in digital banking strategy.

Key Features of Axis Bank’s Safety Centre

Comprehensive Fraud Awareness Content

The Safety Centre provides easy-to-understand information on:

- Phishing emails and SMS scams

- Fake customer care calls

- UPI and QR code frauds

- Investment and loan scams

- Social engineering attacks

The content is designed for users of all age groups and digital literacy levels.

Real-Life Scam Scenarios

To improve relatability, Axis Bank uses real-world examples and scenarios to show how frauds typically occur. This helps customers:

- Recognize patterns

- Understand fraudster behavior

- Learn from past incidents

Such scenario-based learning is more effective than generic warnings.

Do’s and Don’ts for Digital Banking

The Safety Centre clearly outlines:

- What customers should never share (OTP, PIN, CVV)

- How to verify bank communications

- Safe practices for mobile and internet banking

These guidelines act as a quick reference checklist for daily transactions.

Alerts on Latest Fraud Trends

Cybercrime methods evolve rapidly. Axis Bank’s Safety Centre keeps customers informed about:

- New fraud techniques

- Emerging digital threats

- Seasonal scam patterns

Timely updates help users stay ahead of fraudsters.

Why Axis Bank’s Safety Centre Matters

Shift Toward Customer-Centric Security

Traditionally, banks focused on backend security systems. While those remain critical, Axis Bank’s initiative highlights the importance of customer behavior in digital safety.

Many frauds succeed not because systems fail, but because users are tricked into sharing sensitive information. The Safety Centre directly addresses this gap.

Supporting India’s Digital Economy Vision

As India pushes toward a digitally inclusive economy, secure banking becomes essential for:

- Financial inclusion

- Consumer confidence

- Sustainable digital growth

Axis Bank’s Safety Centre aligns with national goals of safe and reliable digital finance.

How the Safety Centre Enhances Trust in Digital Banking

Trust is the foundation of banking. With frequent reports of online fraud, customer confidence can erode quickly. The Safety Centre helps rebuild trust by:

- Showing transparency about risks

- Demonstrating the bank’s proactive approach

- Encouraging shared responsibility between bank and customer

This strengthens long-term customer relationships.

Who Can Benefit from the Safety Centre?

The Safety Centre is useful for:

- First-time digital banking users

- Senior citizens vulnerable to fraud calls

- Young professionals using UPI and mobile banking

- Small business owners handling online payments

By catering to diverse user segments, Axis Bank ensures wide impact.

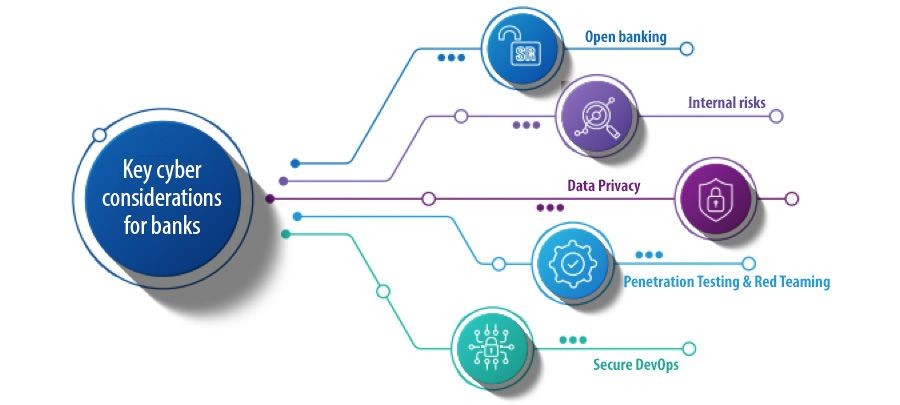

Digital Banking Security: A Shared Responsibility

Axis Bank emphasizes that digital safety is not just the bank’s responsibility—it is a shared effort. While the bank invests heavily in:

- Encryption

- Fraud detection systems

- Secure authentication

Customers must remain vigilant and informed. The Safety Centre bridges this shared responsibility effectively.

How Axis Bank Stands Out Among Indian Banks

With the launch of the Safety Centre, Axis Bank sets itself apart by:

- Prioritizing education alongside technology

- Offering a dedicated security awareness platform

- Addressing fraud prevention holistically

This initiative positions Axis Bank as a leader in responsible digital banking innovation.

Long-Term Impact of the Safety Centre

Over time, the Safety Centre is expected to:

- Reduce fraud incidents

- Improve customer confidence

- Promote safer digital habits

- Strengthen the bank’s brand credibility

As awareness increases, fraudsters find it harder to succeed—creating a safer digital ecosystem for all.

The Future of Digital Banking Security

Axis Bank’s Safety Centre may inspire similar initiatives across the banking sector. The future of digital banking security lies in:

- Continuous customer education

- AI-driven fraud alerts

- Seamless yet secure user experiences

Banks that invest in awareness and prevention will be better positioned in an increasingly digital world.

Conclusion

The launch of Axis Bank’s ‘Safety Centre’ is a timely and impactful response to the growing challenges of digital banking security. By focusing on education, prevention, and empowerment, Axis Bank is not only protecting its customers but also strengthening trust in India’s digital financial ecosystem.

As digital transactions become the norm, initiatives like the Safety Centre will play a crucial role in ensuring that convenience does not come at the cost of security. Axis Bank’s move sets a strong example of how banks can lead with responsibility, innovation, and customer-centric thinking.

In an era where cyber threats are constantly evolving, knowledge truly is the strongest defense—and Axis Bank’s Safety Centre puts that power directly into the hands of its customers.