In a significant move aimed at strengthening the brand identity and public perception of Regional Rural Banks (RRBs), the Ministry of Finance has officially unveiled a new unified logo for Regional Rural Banks across the country. The initiative marks an important milestone in the ongoing efforts to modernize rural banking, enhance customer trust, and create a cohesive national identity for RRBs while preserving their local character.

The introduction of a common logo reflects the government’s broader vision of transforming RRBs into strong, technology-driven, and inclusive financial institutions capable of supporting rural development, financial inclusion, and agricultural growth.

Understanding Regional Rural Banks (RRBs)

Regional Rural Banks were established in 1975 with the objective of extending banking and financial services to rural and semi-urban areas, especially to:

- Small and marginal farmers

- Agricultural labourers

- Artisans

- Micro-entrepreneurs

- Self-help groups and rural households

RRBs function as scheduled commercial banks and play a critical role in implementing government welfare schemes, credit delivery to priority sectors, and promoting financial inclusion in underserved regions.

Over the years, RRBs have emerged as the backbone of rural banking in India, operating at the grassroots level while bridging the gap between formal finance and rural communities.

Why a New Logo for Regional Rural Banks?

The decision to introduce a new logo stems from the need to:

- Create a uniform visual identity across all RRBs

- Improve brand recall and customer confidence

- Reflect modernization and digital readiness

- Align RRB branding with the evolving banking ecosystem

Until now, individual RRBs operated with distinct logos and branding styles, which often led to confusion among customers and diluted the collective strength of the RRB network.

The new logo aims to address these challenges by presenting RRBs as one unified banking system with a strong rural foundation.

Key Objectives Behind the New Logo Initiative

1. Unified National Identity

The new logo provides RRBs with a common visual identity, reinforcing the idea that while RRBs operate regionally, they are part of a larger, integrated national banking framework.

This unified identity is expected to:

- Improve recognition among customers

- Strengthen trust in RRBs

- Enhance institutional credibility

2. Symbol of Trust and Inclusion

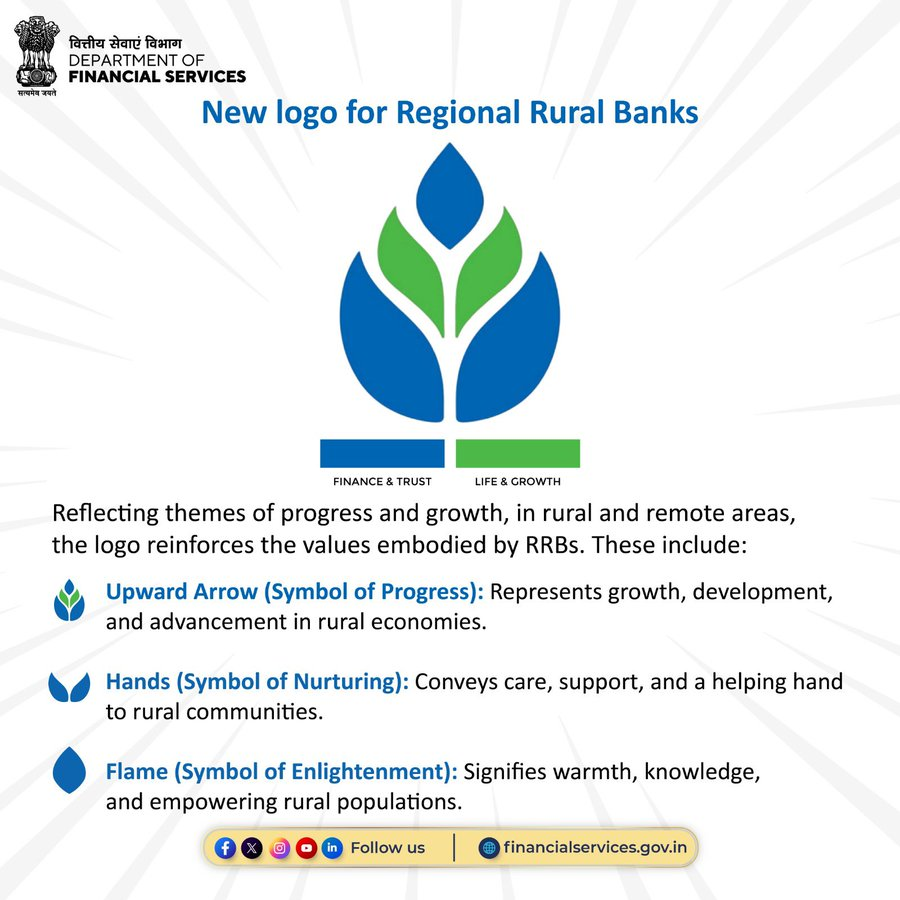

The design of the new logo is intended to reflect:

- Stability and reliability

- Rural roots and community focus

- Financial inclusion and empowerment

By emphasizing these values, the logo communicates RRBs’ core mission of serving rural India with integrity and commitment.

3. Modern and Future-Ready Image

As banking rapidly transitions toward digital platforms, RRBs are also upgrading their technological capabilities. The new logo symbolizes:

- Digital transformation

- Operational efficiency

- Customer-centric banking

It signals that RRBs are evolving to meet the expectations of modern customers while staying true to their developmental role.

Alignment with RRB Reforms and Consolidation

The unveiling of the new logo comes amid a series of reforms undertaken in the RRB sector over the past few years, including:

- Consolidation of RRBs to improve operational efficiency

- Strengthening capital adequacy

- Enhancing governance standards

- Expanding digital banking services

By introducing a common logo, the government aims to complement these structural reforms with a strong brand strategy that reflects institutional stability and growth.

Impact on Customers and Rural Communities

Improved Brand Recognition

A unified logo makes it easier for customers—especially first-time banking users—to identify RRB branches and services across different regions.

Enhanced Trust

Consistency in branding reinforces confidence among rural customers, many of whom rely heavily on trust and familiarity when choosing financial institutions.

Better Awareness of Services

A strong and recognizable brand helps improve awareness of:

- Savings and deposit products

- Agricultural and MSME loans

- Government subsidy schemes

- Digital payment services

This can lead to increased participation in formal banking.

Significance for Financial Inclusion

RRBs are central to India’s financial inclusion agenda. The new logo strengthens this role by:

- Making RRBs more visible and accessible

- Reinforcing their mandate to serve underserved populations

- Supporting outreach efforts in remote areas

A unified identity also enhances the effectiveness of nationwide awareness campaigns related to banking and financial literacy.

Digital Banking and Brand Consistency

With increasing adoption of digital banking platforms such as:

- Mobile banking apps

- Internet banking

- Aadhaar-enabled payment systems

- Direct Benefit Transfer (DBT) mechanisms

a consistent visual identity becomes even more important.

The new logo will be integrated across:

- Branch signage

- Passbooks and cheque books

- Mobile and internet banking interfaces

- ATM screens and marketing materials

This ensures a seamless and recognizable customer experience across physical and digital touchpoints.

Boost to Employee Pride and Institutional Culture

Branding is not only about customers—it also influences employees. The new logo is expected to:

- Foster a sense of unity among RRB employees

- Strengthen institutional pride

- Encourage a shared vision across different RRBs

A strong brand identity can positively impact morale and service quality.

Expert and Industry Reactions

Banking experts have largely welcomed the move, calling it a strategic step toward:

- Strengthening RRB competitiveness

- Enhancing public perception

- Supporting long-term sustainability

Industry analysts note that branding plays a crucial role in modern banking, and the introduction of a common logo places RRBs on a stronger footing alongside public and private sector banks.

Challenges and Implementation

While the initiative is widely appreciated, effective implementation will be key. Challenges may include:

- Ensuring uniform adoption across all RRBs

- Updating physical and digital assets efficiently

- Communicating the change clearly to customers

Authorities are expected to roll out detailed guidelines to ensure a smooth transition.

Long-Term Significance of the New Logo

The new logo is more than a visual change—it represents a strategic shift in how RRBs are positioned within India’s banking ecosystem. Over the long term, it is expected to:

- Strengthen customer loyalty

- Improve brand equity

- Support expansion of banking services in rural areas

- Reinforce confidence in government-backed financial institutions

Conclusion

The Finance Ministry’s unveiling of a new logo for Regional Rural Banks marks an important step toward building a stronger, more unified, and future-ready rural banking system. By combining tradition with modernity, the new logo reflects the evolving role of RRBs as engines of financial inclusion and rural development.

As RRBs continue to expand their reach, adopt digital technologies, and support India’s economic growth at the grassroots level, a cohesive and recognizable brand identity will play a vital role in strengthening public trust and engagement.

This initiative underscores the government’s commitment to empowering rural India through resilient, accessible, and inclusive banking institutions.